In the ever-evolving landscape of finance and technology, asset tokenization has emerged as a groundbreaking concept that is transforming the way we perceive and manage assets.

This innovative approach holds immense potential to reshape traditional financial systems and unlock new opportunities for investors.

In this article, we will delve into the realm of asset tokenization, exploring its definition, and benefits, the blockchain technology that underpins it, and understandings from Asset Tokenization Expert Harman Puri.

Understanding Asset Tokenization

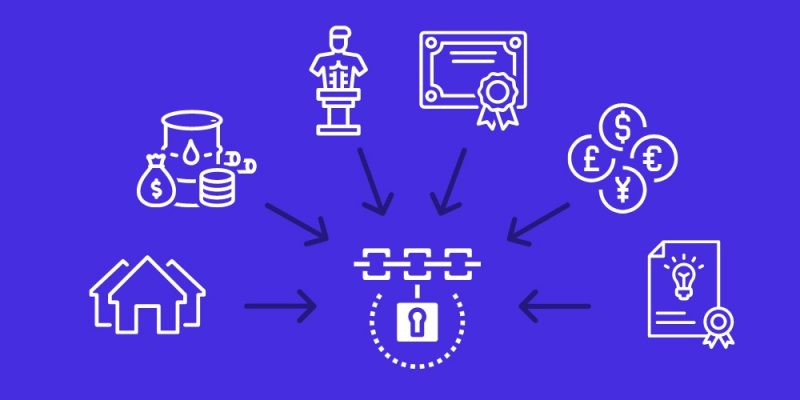

Asset tokenization refers to the process of converting tangible and intangible assets into digital tokens on a blockchain.

These tokens are then bought, sold, and traded like any other digital asset. The blockchain, a decentralized and secure digital ledger, ensures transparency, traceability, and security in the transactions involving these tokens.

This transformative concept has gained significant traction in recent years, offering a wide range of benefits across various industries.

From real estate and art to stocks and commodities, nearly any asset can be tokenized, providing investors with fractional ownership and liquidity.

Benefits of Asset Tokenization

1. Liquidity Enhancement

One of the primary advantages of asset tokenization is the enhanced liquidity it provides.

Traditional assets, such as real estate or fine art, are often illiquid, meaning they cannot be easily bought or sold without a significant time and cost investment.

Asset tokenization allows for the fractional ownership of these assets, enabling investors to buy and sell small portions of an asset, thereby increasing liquidity.

Asset Tokenization Expert Harman Puri emphasizes, “By breaking down large assets into smaller, tradeable tokens, we democratize access to investments.

This opens up opportunities for a broader range of investors, including those with smaller budgets, to participate in markets that were once exclusive to high-net-worth individuals.”

2. Global Accessibility

Traditional financial markets are often restricted by geographic boundaries and regulatory hurdles.

Asset tokenization, however, has the potential to democratize access to global markets.

Through blockchain technology, investors from different corners of the world can seamlessly trade digital tokens, eliminating the need for intermediaries and reducing transaction costs.

Harman Puri, an Asset Tokenization Expert, comments on this aspect, “The borderless nature of blockchain technology allows investors to diversify their portfolios across international markets without the constraints of traditional financial systems.”

3. Fractional Ownership

Asset tokenization enables the division of assets into smaller, more affordable fractions.

This fractional ownership model makes it possible for a broader range of investors to participate in high-value assets.

For example, a luxury property can be tokenized into smaller units, allowing multiple investors to own a share of the property.

Harman Puri explains, “Fractional ownership not only increases accessibility but also reduces the barriers to entry for investors. This democratization of ownership is a significant shift in the investment landscape.”

4. Smart Contracts and Automation

Blockchain’s inherent feature of smart contracts further enhances the efficiency of asset tokenization.

Smart contracts are self-executing contracts with the terms of the agreement directly written into code.

These contracts automate various processes, including dividend distribution, asset transfers, and compliance, reducing the need for intermediaries and minimizing the risk of fraud.

Harman Puri emphasizes, “Smart contracts streamline the entire lifecycle of an investment.

They automate compliance procedures, ensuring that all transactions adhere to regulatory requirements, thereby boosting transparency and trust in the system.”

5. Reduced Costs and Increased Efficiency

Traditional financial transactions involve numerous intermediaries, each charging fees for their services.

Asset tokenization eliminates or significantly reduces the need for intermediaries, resulting in lower transaction costs.

Additionally, the automated processes enabled by blockchain technology reduce the administrative burden, leading to increased operational efficiency.

Asset Tokenization Expert Harman Puri notes, “The cost savings and efficiency gains are compelling factors for both issuers and investors.

With reduced friction in transactions, asset tokenization is poised to disrupt the traditional financial industry.”

How Asset Tokenization Works

The process of asset tokenization involves several key steps:

1. Asset Selection

The first step is choosing the asset to be tokenized. This could be real estate, artwork, stocks, or any other valuable asset.

2. Legal and Regulatory Compliance

Before tokenizing an asset, it is essential to ensure compliance with local regulations. Legal frameworks vary, and navigating these complexities is crucial for a successful tokenization process.

3. Tokenization Platform Selection

Choosing the right blockchain platform for tokenization is critical. Factors such as security, scalability, and the ability to support smart contracts play a significant role in this decision.

4. Tokenization and Smart Contract Creation

Once the platform is selected, the asset is tokenized by creating digital tokens representing ownership. Smart contracts are then drafted to define the rules and conditions of the investment.

5. Distribution of Tokens

The newly created tokens are then distributed to investors. This is often done through a token sale or issuance process, allowing investors to purchase and own a share of the tokenized asset.

6. Trading on Secondary Markets

After the initial issuance, the tokens can be traded on secondary markets. Investors can buy, sell, or trade these tokens, providing liquidity to the asset.

Conclusion

Asset tokenization represents a revolutionary approach to asset management, providing benefits such as liquidity enhancement, global accessibility, fractional ownership, smart contract automation, and cost reduction.

As the industry continues to evolve, the expertise of individuals like Asset Tokenization Expert Harman Puri becomes increasingly valuable in navigating the complexities and realizing the full potential of this transformative technology.

Read More: The Ultimate Guide of Asset Tokenization on Blockchain

Comments